Uranium: The Undervalued Asset in the Global Energy Transition

Feb 26, 2025

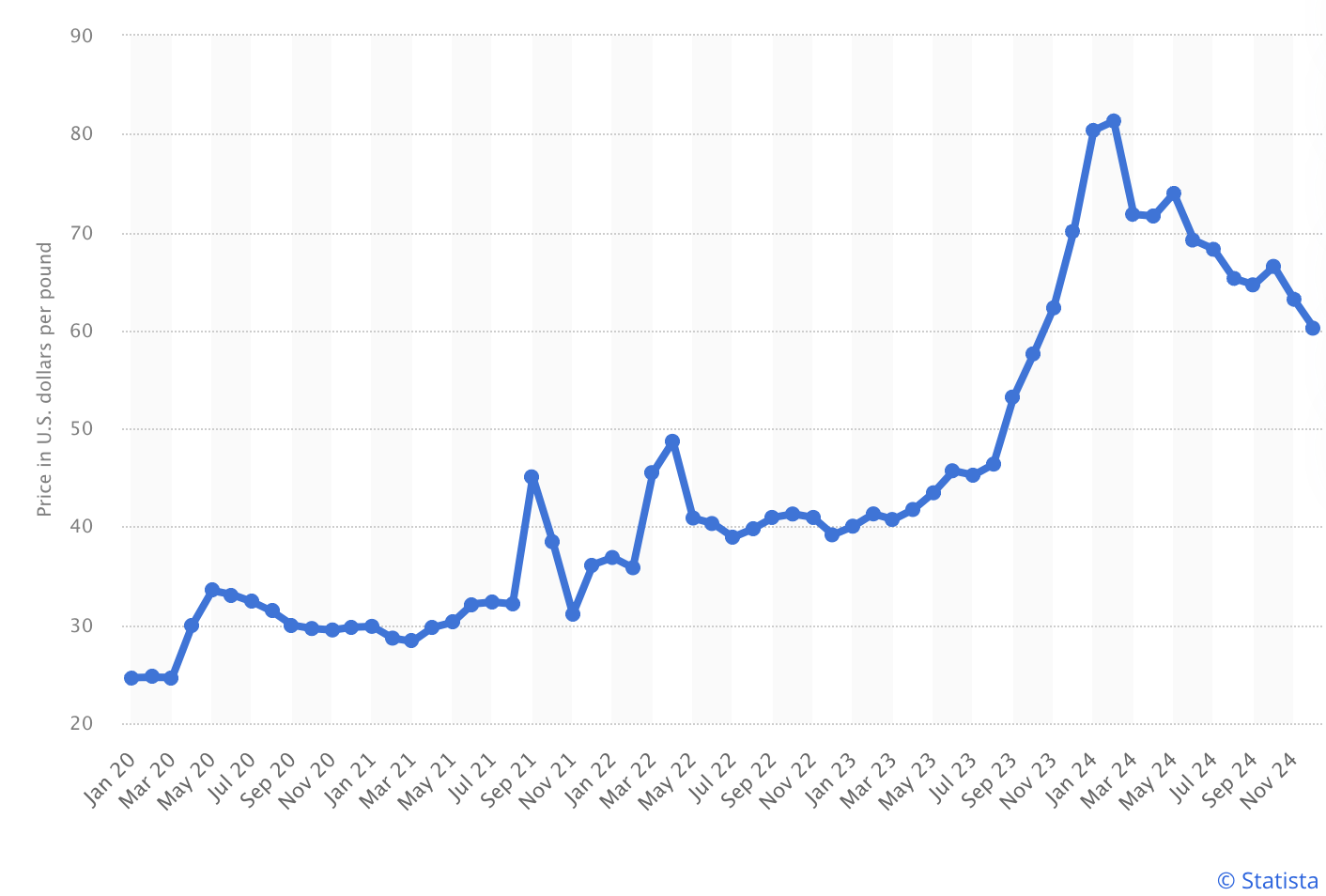

In recent times, uranium prices have experienced a significant decline, dropping approximately 40% from their recent highs. Despite this downturn, the fundamental investment thesis for uranium remains robust, if not more compelling than before. The escalating global demand for energy—driven by the proliferation of electric vehicles (EVs), the rapid expansion of artificial intelligence (AI) technologies, and the urgent need to replace carbon-intensive energy sources—positions nuclear power as a pivotal solution. Nuclear energy is inherently low in carbon emissions, making it a critical component in achieving climate neutrality. As of July 2024, there are 59 nuclear reactors under construction worldwide, underscoring a sustained commitment to nuclear energy. This article delves into the current state of the uranium market, the indispensable role of nuclear power in the global energy landscape, and the compelling investment opportunities that arise from these dynamics.

The Current State of the Uranium Market

As of December 2024, the uranium spot price stood at $60 per pound, reflecting a notable decrease from earlier peaks. This decrease continued in 2025. This decline can be attributed to a confluence of factors, including market volatility, shifts in energy policies, and fluctuations in supply and demand dynamics. However, it's crucial to recognize that commodity markets are inherently cyclical. Historical patterns indicate that periods of price suppression are often followed by rebounds, especially when underlying demand remains strong.

The current price dip presents a strategic opportunity for investors. With the global energy transition gaining momentum, the demand for reliable and clean energy sources is intensifying. Nuclear power, fueled by uranium, is uniquely positioned to meet this demand, suggesting that the recent price decline may be temporary and that a market correction could be imminent.

Global Energy Demand: A Catalyst for Nuclear Power

The global energy landscape is undergoing a transformative shift. Several key factors are contributing to an unprecedented surge in electricity demand:

-

Electrification of Transportation: The global push towards sustainability has accelerated the adoption of electric vehicles (EVs). As transportation electrifies, the demand for electricity grows exponentially.

-

Artificial Intelligence and Data Centers: The proliferation of AI technologies and the expansion of data centers require substantial energy inputs. These facilities operate continuously, consuming vast amounts of electricity to process and store data.

-

Decarbonization Efforts: Nations worldwide are implementing policies to reduce carbon emissions. This involves transitioning from fossil fuels to cleaner energy sources, further amplifying electricity demand.

The International Energy Agency (IEA) projects that electricity consumption from data centers and AI alone could nearly double by 2026. This surge necessitates the expansion of reliable and sustainable energy sources.

Nuclear Energy: Meeting the Demand Sustainably

Nuclear power offers a compelling solution to the burgeoning energy demand. Key attributes include:

-

Low Carbon Emissions: Nuclear energy generation produces negligible greenhouse gas emissions, aligning with global decarbonization goals.

-

High Energy Density: Uranium fuel yields a substantial amount of energy from a small volume, making it efficient and space-saving.

-

Reliability: Nuclear power plants provide a consistent and stable energy output, unaffected by weather conditions, unlike some renewable sources.

As of July 2024, approximately 440 commercial nuclear reactors are operational across about 30 countries, contributing to roughly 9% of the world's electricity supply. Notably, nuclear energy accounts for about one-quarter of the world's low-carbon electricity, underscoring its significance in sustainable energy strategies.

Expansion of Nuclear Power Infrastructure

The commitment to nuclear energy is evident in the ongoing construction of new reactors. As of July 2024, 59 nuclear reactors are under construction globally, with China leading at 25 units, followed by India with seven. This expansion reflects a strategic move to bolster energy security, reduce dependence on fossil fuels, and meet escalating electricity demands.

Moreover, there are significant plans for future developments. As of May 2024, China has announced plans to construct an additional 41 nuclear reactors, indicating a robust pipeline for nuclear infrastructure. This planned expansion is poised to further elevate the demand for uranium, reinforcing its critical role in the energy sector.

Investment Case for Uranium

Several factors coalesce to make uranium an attractive investment:

-

Supply-Demand Dynamics: The construction of new reactors and the planned expansion of nuclear capacity are set to increase uranium demand. Concurrently, supply constraints—stemming from production cuts and delayed mining projects—could tighten the market, potentially driving prices upward.

-

Energy Security Concerns: Geopolitical tensions and the volatility of fossil fuel markets have prompted countries to seek stable energy sources. Nuclear power offers energy independence, reducing exposure to global fuel market fluctuations.

-

Environmental Policies: The global shift towards low-carbon energy sources enhances the appeal of nuclear power. As policies increasingly favor clean energy, uranium, as a fuel for nuclear reactors, stands to benefit.

-

Technological Advancements: Innovations in reactor design, such as Small Modular Reactors (SMRs), promise to make nuclear power more accessible and cost-effective. These advancements could spur further adoption of nuclear energy, increasing uranium demand.

Final Thoughts: The Uranium Trade Is Far from Over

At Vorpp Capital, we see uranium’s recent price drop as a temporary market fluctuation rather than a fundamental weakness. The case for nuclear energy remains stronger than ever, and uranium demand is only set to rise.

As investors, the best opportunities often emerge when sentiment is weak, yet the fundamentals are improving. With nuclear energy’s role in global power generation expanding and the world’s increasing need for stable, clean energy, uranium remains one of the most compelling investment themes for the coming decade.

Do not consider this article as financial advice. We only showcase our own opinion. Always do your own due diligence before investing is alternative (volatile) investment opportunities.

Access all free resources.

- Vorpp Trading Mastery: Free explainer videos to understand and learn trading basics. From understanding the markets to specific technical analysis, this is your entrance into the World of Trading.

- Access to TradeOS: Get our custom-built trading Journal that helps you structure your strategy and stay consistent.

- Passive Investing Guide: Master the principles of long-term wealth building with our easy-to-follow video course.

- Our eBook Trading – The Biggest Mind Game in the World: Understand the mindset behind success in the markets.

- No credit card. No risk. Just value: Click below and become a free member of Vorpp today.