Semiconductors Due for a Major Pullback?

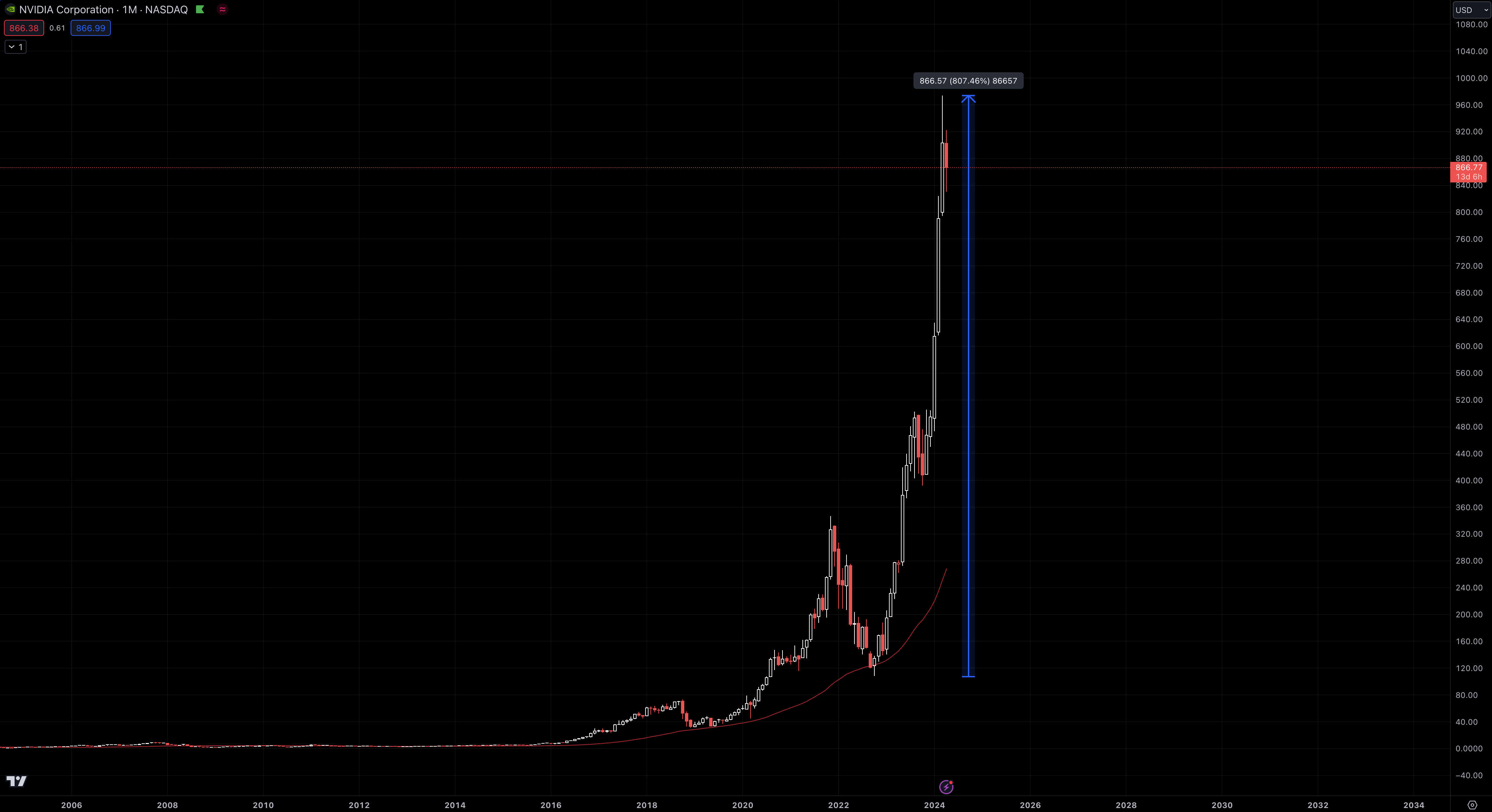

Apr 17, 2024In recent months, semiconductor stocks have experienced an unprecedented rally. Leading the pack, NVIDIA Corp. (NVDA) has seen its stock price soar by an astonishing 805% in just 17 months.

Other key players in the sector, such as SMCI and AMD, have also seen significant gains, with increases of 442% and 316% respectively over similar periods. These bullish surges are typically seen only in select meme coins, highlighting the extraordinary market behavior surrounding semiconductor stocks.

What’s Driving the Surge in Semiconductor Stocks?

The catalyst for this phenomenal growth can largely be attributed to the advent of AI technologies, spearheaded by the release of ChatGPT in late 2022.

This event marked a turning point, showcasing the transformative potential of AI and igniting widespread interest. The brightest minds and leading corporations are now fervently investing in the AI sector, which has become the defining technological arena of the 2020s.

As a result, investors are funneling capital into what is perceived as the most promising sector of the decade.

The Role of Semiconductors in AI Development

Semiconductors are critical in the AI field due to their role in powering the high-performance computing required to run advanced AI programs.

As the leading producer of these essential chips, the semiconductor industry is indispensable to the ongoing success and expansion of AI technologies. Nvidia, recognized as a market leader, has benefited the most from this surge. Their soaring profits reflect the explosive demand for the high-powered chips necessary for AI computation.

Future Trajectories and Market Speculations

While there is little doubt about the continued impact of AI on global industries and daily life—heralded as a revolution akin to the advent of the internet—the financial markets present a more complex picture.

Despite the optimism surrounding AI and its applications, I have a growing concern about the sustainability of such rapid stock price increases without corresponding pullbacks.

Lessons from Tesla: A Parallel to Consider

A pertinent comparison can be drawn with Tesla’s trajectory during the electric vehicle (EV) boom from 2019 to 2021.

Tesla initially dominated the EV market, but as competition intensified, particularly from Chinese EV manufacturers, the company faced new challenges. This competitive pressure led to a significant market correction, with Tesla’s stock retreating by approximately 70% within a year.

What Could the Future Hold for Semiconductor Stocks?

As competition within the semiconductor space intensifies, profit margins may begin to compress, and the extraordinary performance of stocks in this sector could normalize.

The stock market is cyclical by nature, and the key question is not if, but when, these adjustments will occur.

It's important to clarify that this analysis is not a critique of companies like Nvidia, which have performed exceptionally well. Instead, it is a recognition of the typical market dynamics where overperformance eventually regresses towards the mean.

When looking at the technical side of most of the semiconductor stocks, we do see major bearish signs. They are getting ready for a significant pullback. In particular I would like to showcase the chart technicals of Super Micro Computer Inc. (SMCI), as following:

- Head & Shoulders pattern broke to the neckline

- Price retraced to the neckline (previous support) which acts now as resistance

- Price retraced to the .618 fib level

- Reversal candlestick on resistance

- Bearish RSI divergence

Conclusion

In conclusion, while the semiconductor industry remains crucial to the advancement of AI and other high-tech industries, investors and market watchers must remain vigilant. The potential for a market correction is a sobering reminder of the natural ebb and flow of financial markets.

As "Elevate" continues to explore these trends, stay tuned for more insights into how such dynamics are shaping the investment landscape.

Access all free resources.

- Vorpp Trading Mastery: Free explainer videos to understand and learn trading basics. From understanding the markets to specific technical analysis, this is your entrance into the World of Trading.

- Access to TradeOS: Get our custom-built trading Journal that helps you structure your strategy and stay consistent.

- Passive Investing Guide: Master the principles of long-term wealth building with our easy-to-follow video course.

- Our eBook Trading – The Biggest Mind Game in the World: Understand the mindset behind success in the markets.

- No credit card. No risk. Just value: Click below and become a free member of Vorpp today.